Sub-Decree No. 196 (“Sub-Decree 196”) was issued on the 28th of September 2022 by the Royal Government of Cambodia and concerns an amendment to the Tables of Taxable Thresholds for Annual Tax on Income and Monthly Tax on Salary.

The amendments to the progressive Annual Tax on Income and Monthly Tax on Salary tables under Sub-Decree 196 takes effect from 1 January 2023.

The purpose of Sub-Decree 196 is to amend the annual progressive Tax on Income thresholds realized by physical persons, sole proprietorships, and on the distributive share of partners in a partnership that are not classifies as a legal person under the Law on Taxation. Sub-Decree 196 also amends the monthly Tax on Salary thresholds which apply to Cambodian resident employees.

We have tabled the respective changes to annual progressive Tax on Income rates for taxpayers that are not considered legal pesons and the monthly progressive Tax on Salary rates for tax resident employees in Cambodia in the tables below.

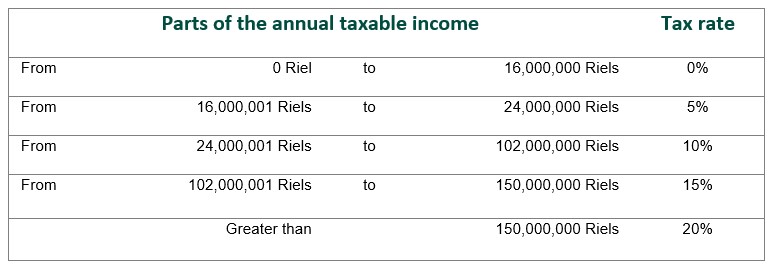

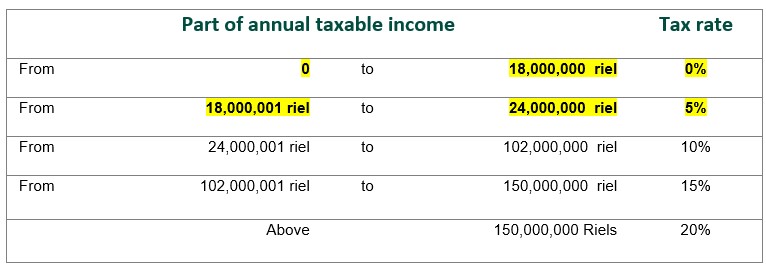

1.) Tax on Income for Physical Persons, Sole Proprietorships, and Partnerships

Prior to 1 January 2023

From 1 January 2023

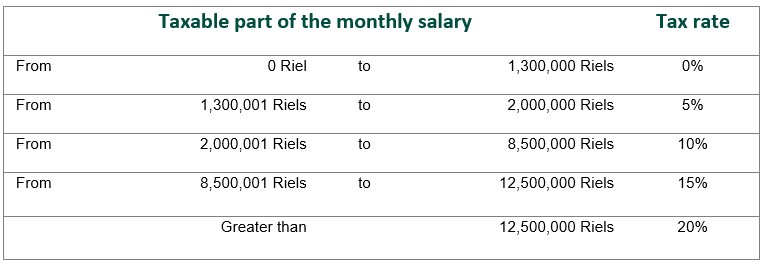

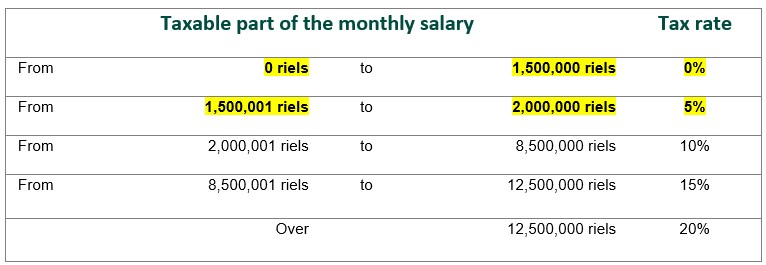

2.) Monthly Tax on Salary for Tax Resident Employees in Cambodia

Prior to 1 January 2023

From 1 January 2023

We note that Sub-Decree 196 will abrogate Sub-Decree No. 09 dated 13 February 2020 once implemented and we expect that the GDT will issue relevant regulations to provide further details on the changes to the tables.

The DFDL tax team has a vast and varied depth of experience with regard to the application of tax treaties, and as always, we stand ready to answer any questions that you may have on this and other tax issues of concern.

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.