On 26 December 2012, the Law on Financial Management 2013 (the “2013 LOFM”) was promulgated to modify the stamp duty provisions which were introduced under Article 40 of the Law on Financial Management 1995 (the “1995 LOFM”). We have recapped below the changes introduced by the new law:

a. What are the new duties introduced by the 2013 LOFM?

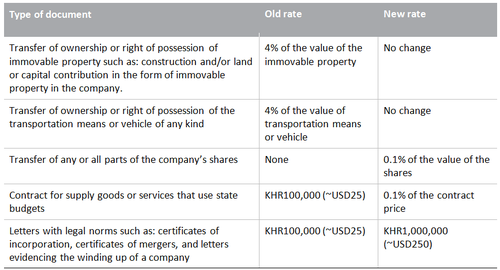

Under the amended provision, the transfer of any or all parts of the company’s shares will be subject to a stamp duty of 0.1% of the value of shares. Additionally, a stamp duty of 0.1% will also apply to any contract for supply goods or services that use state budgets.

b. Which rates have stayed the same and which have changed?

The 4% stamp duty on the transfer of ownership or the right of possession of immovable property such as: construction and/or land or capital contribution in the form of immovable property in the company and the transfer of ownership or the right of possession of transportation means or vehicles of any kind remains unchanged.

The table below illustrates the amendments under the 2013 LOFM:

a. What relief is available?

The 2013 LOFM provides the following exemption and deduction from the stamp duty base:

1. The acquisition of ownership or tenancy right over concession land granted by the Royal Government shall be exempted from stamp duties.

2. The acquisition of ownership or right of possession over immovable property from relatives shall receive the following deduction from the stamp duty base:

– KHR200,000,000 (~USD50,000) in the form of a succession.

– KHR100,000,000 (~USD25,000) in the form of a gift or donation.

b. What is the tax base to calculate the stamp duty?

Immovable property: Under the current practice, the stamp duty on the transfer of immovable property ownership is calculated based on the market value of the immovable property on the day that the ownership or possession right is transferred. Generally, the market value is determined by the General Department of Taxation (“GDT”) and it is not available to the public.

Based on the new provision, the tax base shall remain the same until there is any further notification issued by the Ministry of Economy and Finance (“MOEF”) and/or the General Department of the Taxation (“GDT”).

Shares: The new provision has not clearly specified the value of the tax base of the share transfer in which the stamp duty is calculated and whether it should be based on the par/registered value or the market value of the share at the time of transfer. Additionally, the 2013 LOFM has not mentioned whether this new 0.1% stamp duty also applies to the shares traded in the Cambodia Securities Exchange (“CSX”). We expect that the MOEF and/or the GDT will issue further clarification on how to implement this new tax implication.

Transportation means and vehicle: The MOEF has just issued a Prakas to determine the tax base on the transfer of means of transportation and vehicle of any kind. Please contact us should you need a copy of the Prakas.

c. Does the stamp duty apply only to the certificate of title/hard title?

This matter has been a controversial topic that taxpayers have been asking the government authorities about since the 1995 LOFM was introduced. No explicit answer from the government has been provided. However, practically, the stamp duty applies to the transfer of the hard title of the immovable property (i.e. land and/or building). As such, a 4% stamp duty may not apply to the transfer of the soft title. The coming Prakas from the MOEF will offer further clarification on this matter.

d. To which tax administration should the taxpayer pay the stamp duty?

The stamp duty should be paid to the Department of Law Litigation-Statistic of the GDT for the transfer of immovable property that is situated in Phnom Penh. For the immovable property that is located outside Phnom Penh, the stamp duty should be paid to the respective provincial tax branch where the property is located.

Regarding the stamp duty on the transfer of shares and legal documents for vehicles, the new provision has not yet defined which tax administration the taxpayers should pay the stamp duty to. It is our understanding that the taxpayer should pay the stamp duty to the tax administration the company is registered with.

e. Who is responsible for the payment of the stamp duty?

The 1995 LOFM has defined the person who obtains ownership or right of possession (the “Transferee”) has the obligation to pay the stamp duty to the tax authority. With the silence of the new provision, the 1995 LOFM should still be in force.

f. When is the stamp duty due?

The 2013 LOFM has not modified the tax payment deadline. The stamp duty is due for payment within three (3) months after the transfer based on the 1995 LOFM.

g. When will this amended stamp duty provision be effective?

The Department of Law, Litigation-Statistic of the GDT has confirmed that the new law is not yet effective. The MOFE will issue a series of Prakas that will outline the procedures and implications of each stamp duty. Therefore, the stamp duty provision under 1995 LOMF shall remain in force.

Please contact us should you have any questions on these changes.

DFDL Cambodia

cambodia@dfdl.com