The Ministry of Finance (“MoF”) has introduced a revised circular on Foreign Contractor Tax (“FCT”).

Among the notable changes, the new circular expands the scope of FCT to include the income of foreign entities involved “partly or wholly” in the distribution of goods or the provision of services. FCT now covers transactions in which the foreign entities retain ownership of the goods, bear distribution, advertising or marketing costs, are responsible for the quality of goods or services, make pricing decisions, or authorize/hire other Vietnamese entities to carry out part of the distribution of goods/provision of services in Vietnam.

FCT is a mechanism to collect withholding tax on Vietnam-sourced income generated by non-residents (i.e. offshore entities or individuals without a legal presence in Vietnam) from contracts with Vietnamese entities. For entity (as opposed to individual) FCT consists of a VAT and CIT components.

Effective from 1 October 2014, FCT Circular 103/2014/TT-BTC (“Circular 103”) on 6 August 2014 replaces FCT Circular 60/2012/TT-BTC (“Circular 60”). Key changes under Circular 103 in comparison with Circular 60 are outlined and discussed below.

Changes in the scope of FCT

As above, Circular 103 provides that income from the following activities will fall within the scope of FCT:

– A foreign trader is partly or wholly involved in trading/distribution of goods or furnishing of services in Vietnam where the foreign trader:

- retains the owner/principal of the goods; or

- bears the cost of distribution, advertisement/promotion; or

- is responsible for services’ quality; or

- pre-determine selling price of goods or services;

For instance, where the foreign trader authorizes or hires local companies to partly perform the distribution of goods or other services relevant to the distribution of goods in Vietnam, foreign traders remain subject to FCT. This change would impact online sales companies or those who distribute goods through an agent in Vietnam.

– A foreign trader conducts the rights of import/export and distribution of goods in Vietnam (purchase of goods in Vietnam for exports or sale of goods to Vietnamese trader).

– Foreign organizations/individuals negotiate and conclude contracts with Vietnamese contracting parties via local organizations/individuals.

– In cases of cross-border supply of goods, FCT will be due if the goods delivery method requires the seller to bear any cost/risks in relation to the goods while the goods are inside the territory of Vietnam.

This change in fact is a reiteration of provision of FCT Circulars applicable prior to the issuance of Circular 60. This changes Circular 60 which specified Incoterms delivery methods DDP, DAT, and DAP as being subject to FCT, regardless of whether the destination is at a Vietnamese port or at a customs bonded warehouse.

Certain Vietnam-source income earned by a non-resident is subject to FCT-CIT, including:

– Discounts of treasury notes will now be subject to FCT as interest income;

– Transfer of rights to participate in economic contract/project in Vietnam, asset rights; and

– Compensations for contractual breaches paid by a Vietnamese contracting party.

Supply of goods with warranty provision not subject to FCT

Circular 103 provides that FCT will not be due in the case of a pure trading contract with a stipulation of warranty. FCT will be triggered if the warranty activities are actually performed in Vietnam.

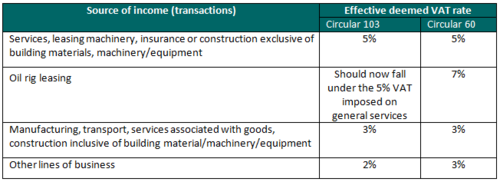

Effective VAT rate under withholding method

– Unlike Circular 60 which states the percentage of turn-over for FCT-VAT computation, Circular 103 directly provides a deemed effective VAT rate for FCT calculation under withholding method.

– The deemed effective FCT-VAT rates under Circular 103 are lower than those under Circular 60 for certain goods/service.

– The deemed VAT rates in comparison with Circular 60 are as follows:

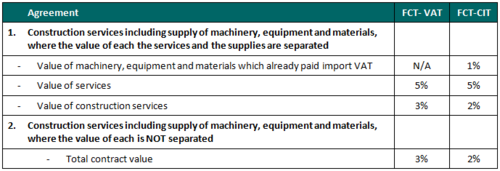

Separation of taxable revenue in case of construction with or without supply of machinery, equipment, and materials

– Under Circular 60, a deemed FCT-VAT of 3% and CIT of 2% apply to construction services including the supply of machinery, equipment and materials and the value of each activity is identified.

– Circular 103 however breaks down the deemed VAT and CIT rates for construction services as follows:

Further notes

– Circular 103 provides guidance in detail for FCT applicable to foreign contractors providing goods/services for oil and gas activities.

– There are no further changes in respect of deemed FCT-CIT rate.

– For filing, Circular 103 introduces further guidance on FCT filings, including new FCT filing form.