PATENT TAX

The General Department of Taxation (“GDT”) recently issuedCircular 286 dated 9 January 2015 (“Circular 286”) which imposes new requirements on the issuance of a taxpayer’s 2015 Patent Tax Certificate. Under Circular 286, all taxpayers who were registered prior to 1 November 2014 are required to update their registration before they can be issued the Patent Tax Certificate for 2015.

In general, the update consists of (i) the personal registration of the taxpayer’s chairman, owner or representative through the submission of various personal information and through a visit to the GDT for the recording of fingerprints and taking of photos; and (ii) the submission of additional taxpayer documentation.

The following are the main documents that need to be submitted to complete the taxpayer update:

- New tax registration application form (the GDT’s form);

- ID card or passport of all shareholder(s) and the chairman. Note that current regulations require the chairman to sign each copy of the passports in blue ink. At times, the tax officers have also required to see the original passports and to make a copy of such original passports in the premises of the GDT;

- Photos (passport size) of all shareholder(s), chairman and director(s). Note that the chairman is required by the current regulations to authenticate each of the photos through his signature. The shareholders and directors are also required to authenticate their own photos through their respective signatures;

- Family book of the taxpayer’s chairman, owner or representative (if they are Cambodian nationals) or their residency letters certifying that they are residents of Cambodia if they are not Cambodian nationals;

- Latest property tax payment receipt of the building/location of the Company’s registered address; and

- Fee of KHR200.000 (~US$50) for the updating of the registration (i.e. the tax identification card and new tax registration certificates).

The new taxpayer registration system and the update rules are still evolving. The tax officers have applied the requirements in varying levels of strictness.

TAX ON SALARY

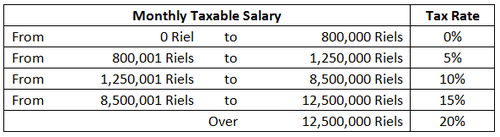

The General Department of Taxation (“GDT”) recently issued Circular 048 dated 6 January 2015 (“Circular 048”) which raises the value of the tax-exempt threshold for the purposes of calculating an employee’s Tax on Salary (“TOS”). The new TOS rates are below:

This new tax-exemption threshold becomes effective for declaring the Tax on Salary of January 2015 onward. If you want to get further information about the coverage of the TOS and other employment tax issues, we in DFDL will schedule a call or meeting to discuss these further. Contact Jude Ocampo (jude.ocampo@dfdl.com) for a discussion of how DFDL can make your compliance with Cambodian employment tax rules as easy as possible.

If you have any questions or require further information, please do not hesitate to contact us.

DFDL Contact:

DFDL Deputy Head of Regional Tax Practice Group