“All that glitters may not be gold”

J. R. R. Tolkien

The recent release in April 2024 by the General Department of Taxation (GDT) of the Standard Operating Procedures on Tax Audits (Tax SOP) and the creation in July 2024 of a Special Tax Audit Unit (STAU) has put the spotlight on the benefits of obtaining gold taxpayer compliance status. With these developments in mind this update examines the criteria, process and benefits that arise from receiving gold taxpayer compliance status for businesses in Cambodia.

Taxpayer Compliance Categories

On 23 December 2016, the Ministry of Economy issued Prakas 1536 MEF which had the stated purpose of creating levels of taxpayer compliance to encourage taxpayers to become compliant with their tax obligations. Prakas 1536 created three levels of taxpayer compliance – (1) Gold, (2) Silver and (3) Bronze.

Based on a list of weighted criteria if a taxpayer can achieve a score of 16-20 points it will be awarded gold taxpayer compliance status, 11-15 points silver taxpayer compliance status is attained and from 1-10 points bronze taxpayer compliance status is attained. The weighted criteria outlined in Prakas 1536 includes the requirements of an entity to register, file and pay taxes (including re-assessed taxes) on time, maintain proper accounting records and have an unblemished record when it comes to charges of negligence and/or serious negligence for tax purposes.

The Process

Historically the GDT awarded gold compliance certificates annually to entities that it had unilaterally assessed had met the criteria as provided for in Prakas 1536. Taxpayers who believe that they had also met the criteria set out in Prakas 1536 can apply to the GDT who then decides whether they can qualify or not as a gold, silver or bronze compliance taxpayer. Prakas 1536 provides that a committee shall be set up by the GDT to receive and review such submissions to ensure transparency and accountability.

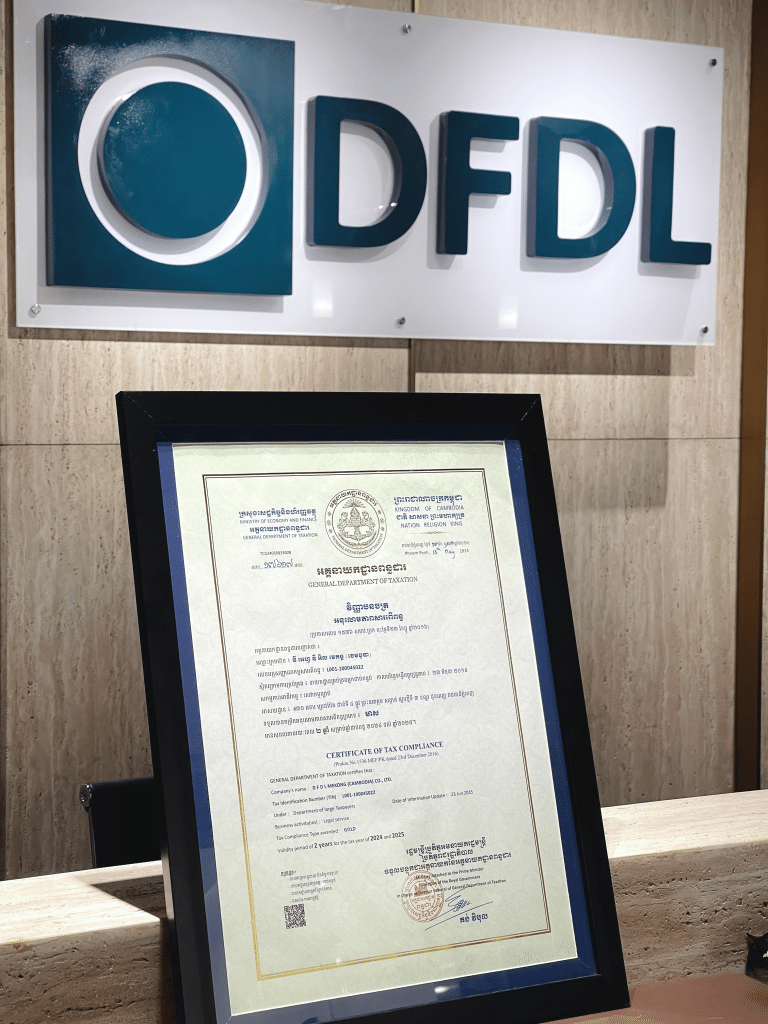

Once awarded the compliance certificate is valid for a period of two years although the GDT reserves the right to revoke or reevaluate the certificate should it discover that the taxpayer at any stage does not meet the criteria set out in Prakas 1536.

Incentives

Circular 007 MEF that was issued on the 4th of August 2017 outlined the incentives that taxpayers who obtained gold, silver or bronze compliance status would be entitled to receive.

- Gold Compliance Status (16-20 points)

Taxpayers who attain gold compliance status receive a certificate of tax

compliance, that is valid for two years. Gold compliance taxpayers will be able to

request a VAT refund below the threshold of KHR 500 million (approx. USD 125,000) without having to undergo a VAT audit.

In addition, gold compliance taxpayers will be subject to one (1) Comprehensive Tax Audit every two (2) years and will not have to undergo a Limited or Desk Audit during the two (2) years that the compliance certificate is in effect for.

- Silver Compliance Status (11-15 points)

Taxpayers who obtain silver compliance status will receive a certificate of tax compliance also valid for two years. Silver compliance taxpayers may request a VAT refund below KHR 200 million (approx. USD 50,000) without having to undergo a VAT audit.

In addition, silver compliance taxpayers will be subject to only one (1) Comprehensive Tax Audit every two (2) years, one (1) Limited Tax Audit every year, and no Desk Audit during the two (2) years that the compliance certificate is effect for.

- Bronze Compliance Status (1-10 points)

Bronze level taxpayers will receive a certificate of tax compliance valid for two years.

Tax Audits

One of the key incentives provided to the holder of a gold compliance certificate was the limitation to only one (1) Comprehensive Tax Audit during the two-year period that the certificate was in effect for.

The tax audit incentive for holders of a gold compliance certificate seemed to be expanded upon the release of the GDT Tax Audit SOP that was issued in April of 2024. The Tax Audit SOP provided the following:

“Enterprises that receive a Gold Compliance Certificate will not be subject to a tax audit while the certificate is valid. However, in the event of a risk or irregularity at any level of compliance, the tax administration may conduct a tax audit to verify compliance. Similarly, tax audits can also be performed for enterprises that have obtained the Gold Compliance Certificate at the request of the enterprise”.

At face value it now seems that the default position is that a holder of a gold compliance certificate will not be subject to any tax audit for the duration of the two years that the certificate is valid. The reference to risk and/or irregularity in the Tax Audit SOP should however be noted as the presence of these factors provides discretion to the GDT to carry out a tax audit even though a taxpayer may have a gold compliance certificate in place.

As per the Tax Audit SOP, risk indicators or irregularities include things such as frequent low tax payments, extended periods without tax payments, frequent changes or discrepancies of invoices, significant year-to-year fluctuations in profit margins, discrepancies in financial statements, irregularities in debt affordability and repayment capacity, and deviations in profitability compared to similar businesses within the same industry.

It should also be noted that a special tax audit unit – the STAU – was recently created by the Cambodian Government. The STAU, which has the same status as a department within the GDT, has been provided with the mandate to oversee tax audits for those taxpayers that have gold compliance status.

One of the stated goals of the STAU is to review documents and risk analysis with respect to a one-time complete audit without conducting desk and limited audits of the enterprises that fall under its jurisdiction. We assume that it will be the STAU that makes the decision as whether a gold compliance certificate holder will be subject to a comprehensive tax audit based on the criteria outlined above i.e. is there a deemed risk or irregularity.

DFDL Commentary

With the GDT looking to carry out approximately 3,006 on-site tax audits in 2024 compliant taxpayers looking to be exempted from what can be a drawn-out and costly tax audit procedure should seriously take into consideration applying for gold compliance certificate status with the GDT. The benefits including an exemption from tax audits for a period of two years and an express VAT refund process are tangible and worthwhile pursuing.

Having assisted several taxpayers in obtaining gold compliance certificate status in Cambodia, DFDL is well placed to ascertain your chances of a successful application and to assist you with the process.

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.