On 29 March 2024, the State Administration Council (“SAC”) enacted the Union Taxation Law 2024 (Law No. 23/2024 or “2024 UTL”), which clarifies the tax rates and procedures for income tax, commercial tax, specific goods tax, and gemstone tax in Myanmar. The law is effective on 1 April 2024 or the start of the financial year 2024-2025.

Among the key highlights of this law pertain to the clarification of the currency to be used for income tax payments, adjustments to the tiers and rates for specific goods tax, and expanded commercial tax exemption for certain goods.

We provide below the salient features of the law:

A. Currency for income tax payments

A notable feature of the 2024 UTL pertains to the obligation of taxpayers to settle income tax liabilities in the currency in which the income was earned. This will cover all types of income tax payments such as corporate income tax, capital gains tax, withholding tax, and personal income tax.

Previously, resident taxpayers, such as citizens and resident foreigners, were required to pay tax in Myanmar kyats in accordance with the conversion procedures outlined in the income tax regulations. Conversely, non-residents who received income in foreign currency were required to pay income tax based on the currency earned. However, this distinction between residents and non-residents has been removed under the new legislation. The 2024 UTL simply states that income tax will be paid based on the type of currency earned or received.

This indicates that the currency for income tax payments will now be determined by the type of currency earned by the taxpayer, regardless of the taxpayer’s residency status in Myanmar. While we understand that this tax payment procedure may not be entirely new for non-residents, this change could affect exporters, individuals receiving salaries in foreign currency, and other taxpayers (including sellers of capital assets) in Myanmar that are receiving income in foreign currency.

We anticipated that the Internal Revenue Department will issue further guidelines regarding the implementation of this change in procedures.

B. Matters relating to Specific Goods Tax (“SGT”)

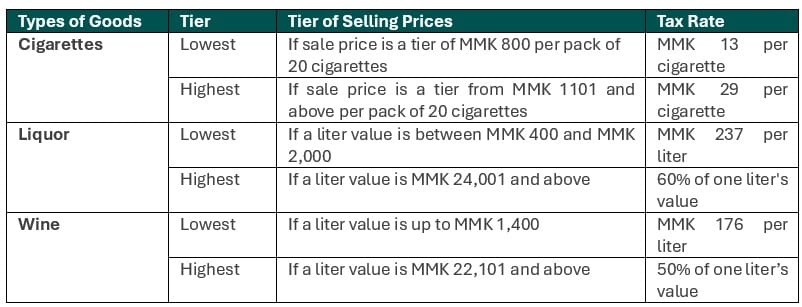

- The 2024 UTL increased the SGT tiers and rates for cigarettes, liquor, and wine. For cigarettes, the SGT tiers were reduced to three instead of four from last year. Effective 1 April 2024, the lowest and highest tiers for cigarettes, liquor, and wine are as follows:

- There are no changes for other types of specific goods listed in the 2024 UTL. The following SGT rates remain for these specific goods:

– Tobacco leaf and Virginia Tobacco: 60%

– Cigar, pipe tobaccos, and various kinds of spices for chewing betel leaf: 80%

– Beer: 60%

– Logs, conversions: 5%

– Vans, Saloon, Sedan and Estate Wagons, Coupe Cars (except double cab 4 door pick-up truck, pick-up cars and batter electric vehicles: 10-50%

– Kerosene, Petrol, Diesel, and Jet Fuel: 5%

– Natural Gas: 8%

C. Matters relating to Commercial Tax (“CT”)

- There are no major changes for CT under the 2024 UTL. The general CT rate remains at 5%, except for the following:

– internet services: 15%

– sale of SIM card and related services: MMK 20,000 per SIM card

– hotel and tourism services: 3%

– sale of buildings constructed in Myanmar, whether through a long-term lease with the State, or through a partnership with a lessor: 3%

– sale of gold jewelry: 1%

– export sale of electric power: 8%

- The 2024 UTL enumerated 47 exempt goods and 34 exempt services. The addition to the CT exempt goods for this year pertains to “goods that are re-imported under the repair and return system without affecting the original condition of the goods after being repaired overseas, in accordance with customs procedures due to defects sustained.”

D. Matters relating to Income Tax

- The general corporate income tax (“CIT”) rate remains at 22%. Companies listed in the Yangon Stock Exchange are subject to 17% CIT while companies engaged in the oil and gas exploration and production sector are subject to 25%.

- There is no change in the income tax exemption thresholds for small, micro, or medium-sized enterprise (based on industry). The tax exemption threshold remains at MMK 15 million per year for three consecutive years, including the year of business commencement.

- Capital gains tax (“CGT”) rate remains at 10%, except for companies engaged in oil and gas exploration and production sector where they are subject to a higher CGT rate of 40% to 50%.

- Individual personal income tax (“PIT”) rates remain at graduated rates of 0-25%. PIT exemption still applies if the individual’s annual income does not exceed MMK 4.8 million (approx. USD 2,300). For non-resident Myanmar citizens employed overseas, they will be subject to PIT on foreign-sourced salary based on the lower of the following calculations:

(i) The prevailing PIT rates (i.e., 0% – 25%) after deducting the relief and allowances under the Income Tax Law (“ITL”); or

(ii) A flat rate of 2% without deductions for relief and allowances under the ITL.

Any foreign tax imposed on the income of non-resident citizens can be offset against the tax payable in Myanmar. The embassy officers and consular officers of respective foreign missions must collect the applicable PIT from non-resident Myanmar citizens. - There are no changes in the income tax rates for undisclosed sources of income. This tax is payable by Myanmar citizens who are unable to show the source of income used for buying, constructing, or obtaining any assets, and establishing new businesses. Income tax remains at progressive rates from 3-30%.

E. Matters relating to Gemstone Tax

There are no changes for gemstone tax. The sale of gemstones in Myanmar remains to be subject to royalty/gemstones tax of 5% to 11%. The tax rate will depend on the type of gems and whether they are sold as raw stone or finished jewelry.

Should you need any assistance or wish to know more about the topic, DFDL stands ready and willing to assist you.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.