On 7 February 2024, the Prime Minister of Vietnam issued Decision No. 165/QD-TTg on approving Vietnam’s Hydrogen energy development strategy until 2030, with a vision to 2050 (“Decision 165”), with immediate effect.

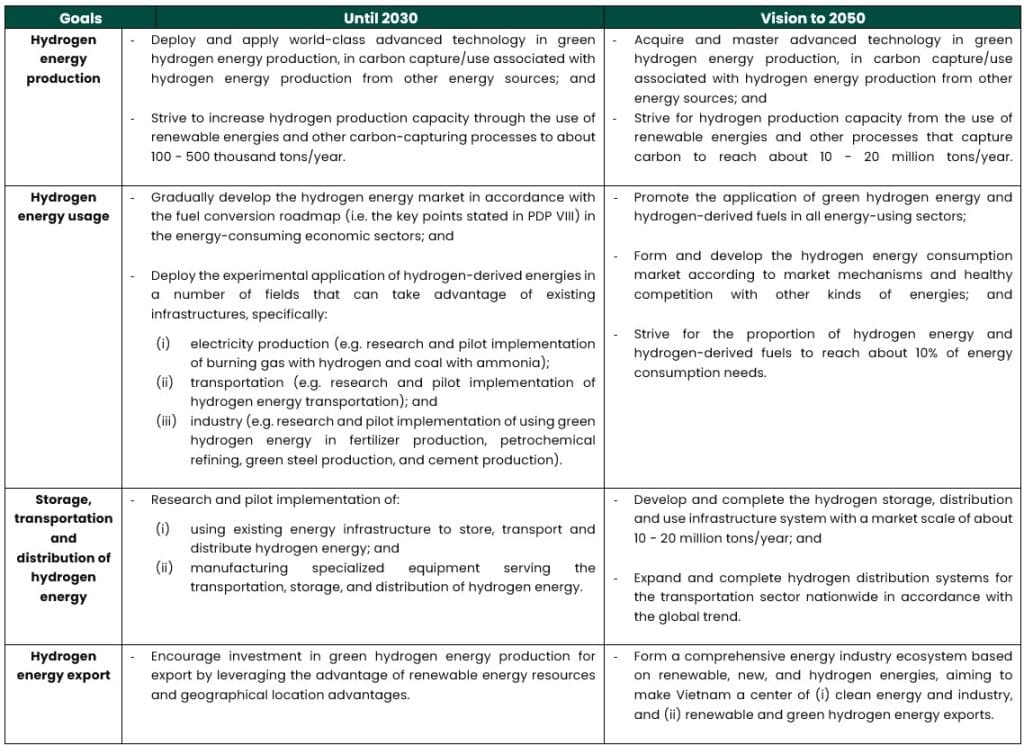

Decision 165 outlines key policies for the development of hydrogen energy, ensuring consistency with the National Energy Development Strategy and Decision No. 500/QD-TTG of the Prime Minister of Vietnam dated 15 May 2023 on approving the National Power Development Plan for the period of 2021 – 2030, with a vision to 2050 (“PDP VIII”). Decision 165 identifies the following key goals:

Regarding solutions for hydrogen energy development implementation, Decision 165 identifies key requirements applicable to the mechanisms and policies for hydrogen energy development, specifically:

(i) developing regulations on renewable energy development policies (including the hydrogen energy source) in the Law on Electricity; issuing regulations on the authority to decide investment policy for offshore wind power projects, hydrogen/ammonia export and production projects using renewable energies; and

(ii) creating a legal corridor for enterprises using fossil energies to participate in the transition to hydrogen energy; developing preferential mechanisms and policies (e.g. taxes, fees, land rights, etc.) to attract investment and develop the hydrogen energy sector; and reviewing, amending and supplementing national standards and regulations in the hydrogen energy sector in accordance with international regulations and standards.

The tax incentives for renewable energy projects can be applied to hydrogen projects. These tax incentives include a preferential income tax rate of 10%, income tax exemption and reduction for a certain period of time, exemption of import duties of certain imported goods, and exemption or reduction of land and water rental fees. Decision 165 is expected to introduce new incentive policies for the green hydrogen energy sector, which will attract more investors to this field.

The information provided is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.