On 21 November 2018, Thailand introduced a new transfer pricing law which became effective for the fiscal year commencing on 1 January 2019. Thereafter, the Thai Revenue Department (“TRD”) amended and revised the Thai Revenue Code by enacting Royal Decree No. 47 (“RD47”). Under RD47, companies established under Thai law are subject to TP documentation rules if they have annual turnover of at least THB 200 million (USD 6 million).

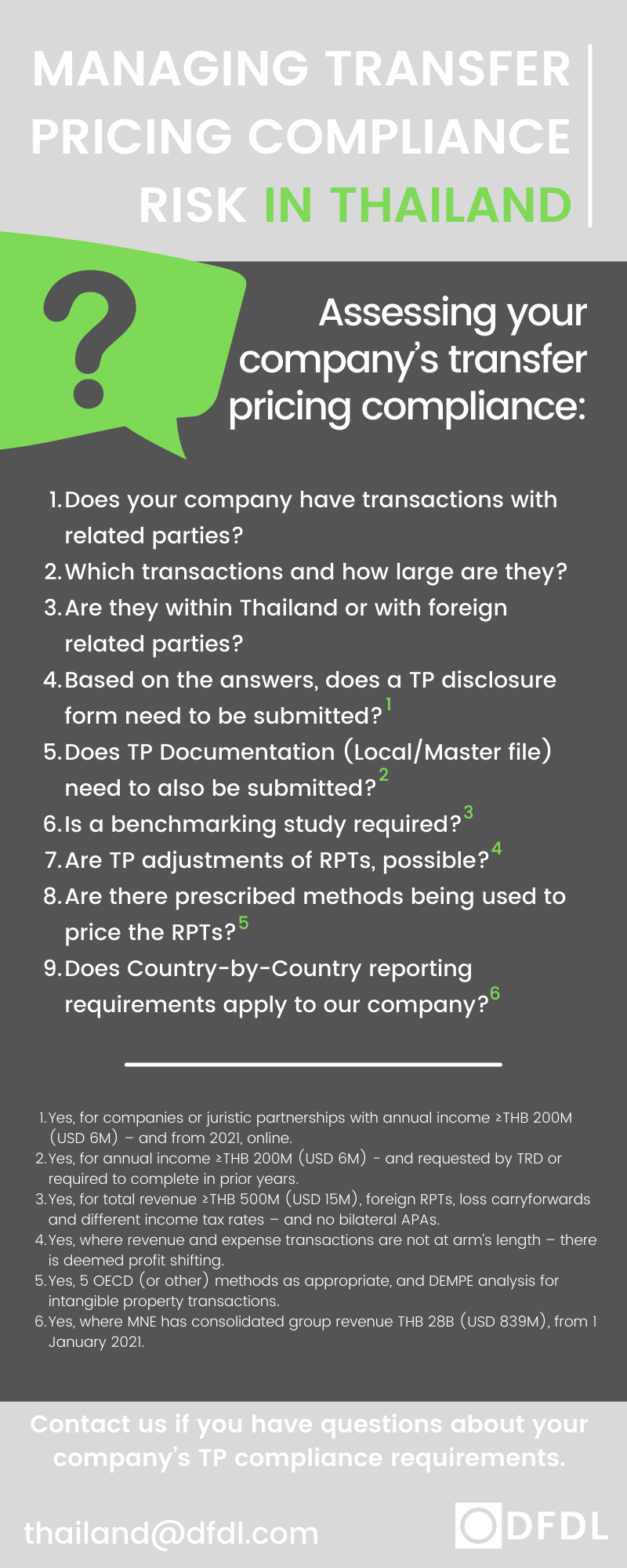

In this infographic, our Transfer Pricing expert, Christine Schwarzl (Regional Transfer Pricing Director) outlines the key questions that a company operating in Thailand needs to consider when assessing its transfer pricing situation and how to ensure it stays compliant with TP rules.

Don’t hesitate to reach out to our expert should you need advice on your company’s TP compliance requirements.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.