The new Tax Law amending key tax laws including Corporate Income Tax, Personal Income Tax, Value Added Tax and Tax Administration and the Amended Law on the Special Sale Tax was passed in late November. Effective from 1 January 2015, the new Tax Law affirms most of the tax reforms proposed in the Resolution 63 of the Government dated 25 August 2014.

Significant changes under the new amended Tax Laws are outlined and discussed below.

Corporate Income Tax (“CIT”)

1. Removal of the cap on tax deduction for advertising and promotional (A&P) costs.

2. New investment projects engaged in manufacturing industrial supporting products and projects engaging agriculture and aquaculture products or those meeting certain other criteria will be entitled to tax incentives.

The new amended Tax Law allows existing investment projects to re-assess and apply tax incentives granted in the new Tax Law for the remaining incentive period of the projects if those incentives are more favorable than its initial incentives. It is however unclear if the existing investment projects that have not been entitled to any incentives (i.e. investment projects engaging in production of industrial supporting products above, or those located in industrial parks) could avail of this provision for re-assessment of their CIT incentive entitlements. Hopefully, this matter would be clarified in the guiding Decree/Circular of the new Tax Law.

Personal Income Tax (“PIT”)

1. Income from winnings at a casino is no longer subject to PIT.

2. Employment income of Vietnamese crew members working for foreign shipping companies or Vietnamese shipping companies that provide international transport services is PIT exempt.

3.Income of shipping owner or individuals working on vessels that provide goods/services to offshore fisheries activities is also PIT exempt.

4. Tax base for computation of income from transfer of securities and transfer of real property generated by residents will be the sale proceeds. This means that, similar to non-residents, income from transfer of securities and real property by residents shall be subject to PIT at deemed rate of 0.1% and 2% on the sale proceeds respectively.

5. Business income is no longer subject to PIT at progressive rates as employment income. Business income, under the new Tax Law, is subject to PIT at flat rates of 0.5% to 5% depending on particular business activities, if the annual business income is in excess of VND 100 million.

Tax Administration

1. Further simplification on tax administration and filing is introduced:

– List of input invoices and output invoices (purchase and sales) is no longer required for monthly or quarterly tax filing report.

– Taxpayers are generally no longer required to further submit particular documents that have already been available (or submitted) to the government authorities, based on detailed guidance of the government. This would indicate that taxpayers’ data should be linked and shared among government authorities to avoid multiple submissions of same documents. The application of this in practice would not be straightforward.

2. The interest rate of 0.07% per day on overdue tax payment of more than 90 days is abolished. Overdue tax payment is now subject to a single interest rate of 0.05% per day.

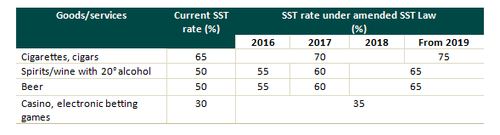

Increase of Special Sale Tax (SST) Special Sale Tax (SST) rate on certain goods/services

From 1 January 2016, SST rate of certain goods will be increased in comparison to the current tax rates: