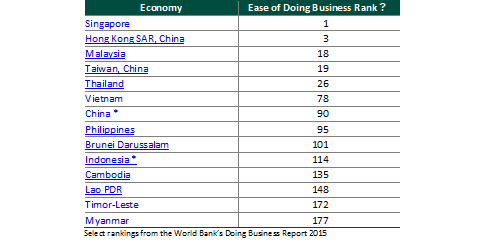

On October 1 2014, nine foreign banks were granted provisional operating licenses in Myanmar, bringing a change that most investors have been hoping for since the revamp of the Foreign Investment Law of 2012. While the World Bank still ranks Myanmar low (177 out or 189 economies) for doing business, liberalization and maturation of the banking sector is significant for an economy like Myanmar’s that is largely cash-based and propelled mainly by large-scale foreign investment.

The presence of foreign banks within the Myanmar banking system will overall enhance institutional strength, and will make headway into a banking system that is currently monopolized by four state owned banks. Although the international banks may face “supervisory” and “managerial challenges”, it is by far one of the most important steps towards the transformation of the financial sector of this country.

A recent analysis by international crediting association Moody’s found bank loans comprise only 19% of Myanmar’s GDP. Other figures from the International Monetary Fund found that Myanmar’s current account deficit has widened to 4.4% of GDP in the last fiscal year ending in March 2013, down from a surplus of 0.4% at the end of the 2008 fiscal year. In recent weeks this has significantly impacted the kyat, which has sunk to its lowest since being floated two years ago.

The Asian Development Bank said the provisional licenses for foreign banks in Myanmar will pave the way for the country’s debut sovereign bond sale, expected in the next five years.

In 2014 Myanmar’s banking sector has also seen the launch of a number of smaller privately and publicly-owned local banks and both local and foreign microfinance institutions. The launch of two major telecoms operators has also made way for the beginnings of mobile money operations in the country. In December 2013, the country published its first Mobile Banking Directive, which adopts the “bank-led” model for mobile money.

The Myanmar Payment Union, launched in 2011 and comprised of more than 20 banks, has expanded its debit card network and nationwide ATM network this year. This initiative allows ATM card holders to withdraw cash from ATMs operated by all member banks, rather than being restricted to a single bank. The electronic banking network now covers 80% of all banks’ existing workloads.

The Foreign Banking Licenses

Previously, foreign banks’ operations were extremely restricted, being able to only establish a Representative Office in Myanmar and not undertake any substantive financial services activities in country. Under Myanmar law, a Representative Office may operate only as a research and marketing entity, and is strictly banned from engaging in any sort of income generating activity.

The recent issuance of licenses to foreign banks have seen a shift in government policy in relation to banking laws as it appears to have conservatively loosened some of its restrictions. The provisional licenses granted to the nine winning foreign banks by the Central Bank of Myanmar (“CBM”) allow each bank to form one “branch office” in Myanmar. Under Myanmar law a branch office is distinct from a representative office or a company in that final liability of the branch rests with the parent company and it is able to conduct business activities that are revenue generating. Branch offices are also exposed to a higher tax rate than locally incorporated companies.

Under the terms of the provisional licenses, the foreign bank branch office may provide loans to foreign entities in foreign currency, but is prohibited in engaging in retail banking in the local market or lending to local companies. There is provision for the foreign bank branches to provide some local banking services via a partnership with a local bank, including provision of loans in the local currency, the kyat. The nine winning banks must bring in capital of at least USD 75 million before financial products and services can begin. The winners have been given 12 months to prepare to launch services that comply with proposals made in the tenders and open a branch.

Vice governor of the CBM, Winston Set Aung recently indicated that the government-set lending rates (13%) and minimum deposit rates (8%) would not apply to loans extended by the foreign banks to foreign investors. Mr. Set Aung has also addressed the issue of “syndicated loans”, loans that are offered by a group of lenders who work together as a “syndicate”, providing funds to a single borrower. The nature of these loans are predominantly large in nature, and its terms and interest rates could vary subjectively, depending on the agreed upon terms between the parties. (i.e., fixed amounts, credit lines, or a combination of the two). From a Myanmar banking perspective, it could, in theory, provide an outlet for further exposure of foreign banks with local Myanmar businesses.

Legal framework and latest developments

The Myanmar banking sector is overseen by the CBM, which was established in 1948 after independence. Since the CBM Law passed in 2013, the CBM, which is an autonomous institution under the Ministry of Finance and Revenue, acts as the licensing authority and regulator of all banks in Myanmar, state-owned and private and also has statutory responsibility for developing capital markets.

Under the Financial Institutions of Myanmar Law of 1990 the CBM can license four kinds of financial institution: commercial banks, investment or development banks, finance companies and credit societies. There are currently five specialized state-owned banks, one non-banking state-owned (non-insurance) financial institution in Myanmar and 20 privately owned banks and more than 20 foreign owned microfinance institutions (MFI) out of a total of almost 200 licensed MFI in the country.

More recently a new draft Bank and Financial Institutions Law has been published for debate. The very lengthy legislative instrument intends to govern the whole banking and finance sector. Importantly for foreign investors, the draft Law details applications procedures for foreign bank and non-banking financial institutions, indicating that foreign investment in this sector could be further liberalized in the near future.

Onshore banking developments

Since 2 July 2012, the CBM has released three new directives that give a more structured approached to onshore banking.

In Myanmar, there are two types of foreign remittance transactions: a) current account remittances, and b) capital account remittances. The Foreign Exchange Management Law 2012 (“FEML”) provides the following examples of what constitutes current account remittances (this is not a comprehensive list, as similar transactions may be constituted as a “current account transactions”). Current account remittances are defined as transactions that deal with day to day recurring transactions and consist of the following:

- Trade, ordinary account remit settlement including services and payment on short term bank credits;

- Net profits from investment and credit interests;

- Installment debits for credit or direct investment for depreciation;

- Remittances from local or foreign for family members.

These transactions require CBM permission for the initial transaction, but subsequent transactions do not require this approval. Transactions which fall outside this list are considered under the law as capital account transactions and technically require permission from the CBM for every transaction made.

Notification № 13/2012 develops the domestic foreign currency market by setting out the rules and regulations on granting permissions for local privately-owned banks holding “authorized dealer licenses” to engage in trading for

eign currencies. The Notification allows private banks, with the exception of certain activities, to accept and open current accounts in foreign currency but restricts withdrawals to a maximum of USD 10,000 or equivalent twice per week and stipulates the kinds of currencies that the private banks are allowed to hold.

Notification № 15/2012 of the CBM is very similar to Notification № 13/2012 in that it sets out the rules and regulations that private owned banks must adhere to in relation to dealing with foreign currency.

The most recent CBM directive released on 4 July 2014 gives more clarity to the requirements for local banks to approve payments (i.e. obtain CBM approval). The effect of this directive is to regulate of all kinds of loans which the FEML said were “free of restrictions direct or indirect”. This directive requires banks seek CBM approval before accepting foreign loan payment and instructs the banks to “securitize payments for loans” transferred from overseas in a “systematic way” as prescribed by the directive before submitting it

to the CBM. Furthermore, it directs the concerned company or investor to obtain the approval from the CBM for the loan payments (discussed below).

Cross Border and Offshore Banking: Foreign exchange management

Foreign Exchange Management Regulation Notification № 7/2014 (“FEMR”) by the CBM was issued on 30 September 2014.

The FEMR outlines the duties of authorized dealer license holders, defined in the FEML as licence holders that are allowed to carry out foreign exchange activities. These activities include acceptance, exchange, purchase, sale in respect of foreign exchange whether inbound or outbound. Companies or individuals that provide financial advisory services do not require an authorized dealer licenses unless they will be handling transactions and remittances. The FEMR also outlines the procedures for foreign currency remittances and transactions, particularly the documentary evidence requirements for accepting and remitting foreign exchange from or to abroad.

Like the FEML, the FEMR treats Myanmar citizens and foreigners who have been in the country for at least 183 days out of the preceding 12 month period and companies and offices registered under domestic law the same, calling this group “residents”.

The FEMR also creates a liquidity cap of USD 10,000 or equivalent foreign currency for most situations that relate to foreign currency transactions. For instance, up to USD 10,000 or equivalent foreign currency which has been obtained legally may be brought into the country without restrictions. And, if this foreign currency is not used within six months of it being brought into the country, it must be converted to kyat by being sold to an authorized dealer licensee or being deposited in a bank account. In our view, this notification has been introduced with an aim to incentivize the use of banks by residents in Myanmar. Likewise, authorized dealer license holders may not carry out outward remittances in any amount which exceed USD 10,000 without the prior approval of the CBM.

Under the FEMR, authorized dealer licenses are assigned the main responsibility for collecting and verifying the supporting documentation for foreign exchange transactions.

Importantly for investors, Regulations 48 and 49 of the FEMR provide that every resident must apply for a prior approval from the CBM before taking an offshore loan by submitting a loan agreement and other supporting documents. For companies holding a MIC Permit, the approval of the Myanmar Investment Commission (“MIC”) is required, which process also involves the MIC requesting a letter of ‘no objection’ to the loan from the CBM. Under FEMR, authorized banks are obligated to ensure all transactions relating to repayments of loan and payment of interest are made only if the loan has been approved by the CBM. Significantly, it would mean that that once a loan agreement and repayment schedule are approved by the MIC and/or CBM, there is no further need for such approval for every remittance payment under the loan agreement to the extent that those payments have been included in the repayment schedule submitted to and approved by the MIC and/or CBM.

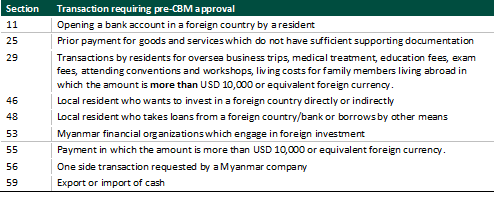

And approval from the CBM is still required for the following types of transactions:

Chapter 2 of the FEMR outlines documentation requirements for a foreign exchange transaction. Chapters 3 and 4 provide the requirements for opening a foreign currency bank account at a local bank. These requirements include the approval of the CBM. Chapters 5 and 6 address the operations and allowed activities regarding foreign currency in relation to current accounts, while Chapters 7 and 8 address capital account transactions. The remainder of the FEMR outlines allowable activities and mandated procedures for other foreign currency activities.

Yangon Stock Exchange

The rules and regulations to the Securities Exchange Law 2013 have been drafted, but not yet made public. It is expected the rules could be passed as soon as the end of 2014. The passing of the Security Exchange Law in 2013 is considered a step forward in establishing a functioning stock exchange as it essentially provides the framework to set up the Yangon Stock Exchange, an integral part any advanced capital market. However, the rules and regulations for the operation of the Yangon Stock Exchange will need to be issued in a timely manner if the Exchange is to launch as expected in Quarter Four 2015.

The Securities Exchange Certificate Law 2013 gives some indication about the level of regulation the Yangon Stock Exchange and its participants will be provided and governed by. The Securities Exchange Certificate Law provides for the formation of a supervisory commission that will license and supervise businesses and individuals wishing to act as brokers or agents for stock exchange activities. The five-member supervisory commission has broad powers to grant licenses, approve or disapprove listings, halt the stock market or particular trading activities and appoint auditors. The supervisory commission is also the regulator for the operation and creation of formalized over-the-counter trading markets.

The Securities Exchange Certificate Law also provides some of the requirements for investors and entrepreneurs wanting to act as agents and brokers for the Yangon Stock Exchange. The Law requires these parties incorporate a private company limited by shares under Myanmar law with the expression “securities exchange certificate” in the company name. Individuals can apply for a license from the supervisory commission to act as agents, brokers, traders and as investment consultants.

DFDL Analysis

DFDL sees the granting of provisional licenses to foreign banks as a step in the right direction for Myanmar’s tightly controlled banking sector. It is however unclear at this time exactly how the granting of the commercial lending licenses to the nine international banks will change currently developing offshore lending practices. There are currently large projects that contemplate offshore debt financing that are working through MIC and the CBM. The international banks that will be providing the debt financing of course do not have a specific CBM commercial lending license. At the very least, however, more international banking activity in Myanmar can only be a positive development: it will lead to a more advanced understanding of complex banking and financial industry with a conducive and appropriate regulatory framework that will encourage and enable a more vibrant commercial environment and economy.