Effective immediately, the GDT (General Department of Taxation) has abolished an earlier existing practice that saved taxpayers much time and worry in relation to tax audits. To date, when taxpayers in the Real Regime of Taxation (which includes all companies) received an invitation for a desk audit or a limited tax audit, such audit would not be carried out if the taxpayer voluntarily requested a comprehensive tax audit for the same tax year. Similarly, when a comprehensive audit was already announced for the same year, the limited audit would not be carried out. The presumption is that any issues would be uncovered in a comprehensive audit anyway, so there is no need for a second and more limited audit.

In other words, one could avoid having to do the same audit twice by opting for the comprehensive audit. The rationale is clear for the taxpayer. Tax audits absorb a lot of resources for companies, and it makes sense to go through the exercise “once and for all” rather than twice. In practice, so-called limited audits are actually often quite extensive and can take several years.

Cambodia has three types of audit: desk audit, limited audit and comprehensive audit. In addition, an audit can be connected to a request for a VAT refund. The first two types of audit, notable the desk and limited audit, are carried out by the Department of the GDT where the tax payer is registered and files his tax returns. In the case of large enterprises, desk audits and limited audits are carried out by the DLT. Other taxpayers in Phnom Penh come under their respective district (or Khan) which carries out the desk audits and limited audits. Independently, comprehensive tax audits are carried out by the DEA. As the word suggests, a limited tax audit can cover only one or a few taxes or issue, such as only VAT, while a comprehensive audit is a detailed verification of all the taxpayers’ tax compliance obligations.

All these types of audit are relatively frequent in Cambodia. It is therefore entirely feasible that an enterprise may be subjected to one or more different tax audits for one or more tax years.

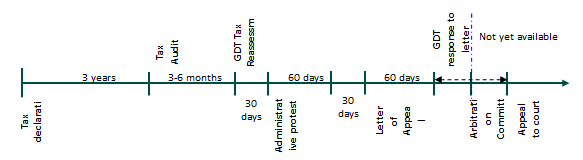

Timeline in assessment and appeal process according to the Law on Taxation:

Penalties for Late Payment or Non-payment of Tax

Tax penalties are imposed for violations of the LOT and its regulations. The level of penalty is dependent upon the nature of the violation, and is determined as follows:

Where a taxpayer or withholding agent is considered negligent (where there is a less than 10% differential between the amount of tax originally paid and the amount of tax reassessed) the amount of penalty will be 10% of the unpaid tax;

Where a taxpayer or withholding agent is considered seriously negligent (where differential between tax paid and tax reassessed exceeds 10% or the taxpayer has failed to settle tax liabilities by the due date) the amount of penalty will be 25% of the unpaid tax; and

Where the taxpayer or withholding agent receives a unilateral tax assessment the amount of the penalty will be 40% of the unpaid tax.

In addition, there are penalties imposed for late payment of taxes and late lodgment of returns, together with interest that is charged at 2% per month.

For evasion or obstruction of tax implementation, which are both considered as criminal offenses, besides additional tax, offenders will face a fine from KHR10,000,000 (approximately US$2,500) to KHR20,000,000 (approximately US$5,000) and/or imprisonment from one to five years, in case of evasion, and a fine from KHR5,000,000 (approximately US$1,250) to KHR10,000,000 and/or imprisonment from one month to one year, in case of obstruction of tax implementation.

No longer possible to avoid double audits

Effective immediately, requests from taxpayers for a comprehensive audit to cancel a limited audit will no longer delay or prevent the limited audit. Any desk or limited audit will have to be completed, regardless of the fact that a comprehensive audit will be carried out for the same tax year. Taxpayers will have to ensure they free up the resources to follow up both audits with both teams from the GDT.

If you have any questions about this Tax Update, please send us an email to: cambodia@dfdl.com

5 September 2011