Following the enactment of Sub-Decree No. 196 (“Sub-Decree 196”) on the 28th of September 2022 by the Royal Government of Cambodia (click here ) the Ministry of Economy and Finance (MEF) issued Instruction 017 on the 27th of December 2022 on the Implementation of the new rates of Tax on Salary.

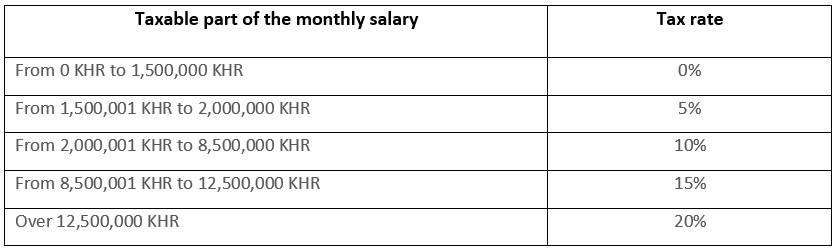

From January 2023 the table of new progressive monthly tax rates to be applied on the monthly gross salary of resident employees are as follows:

Rebate for spouse and dependent children

The current rebate amount for each dependent child and non-working spouse remains the same at KHR 150,000. In order to claim a deduction for a child, the child must be under 14, or under 25 and a full-time student at an accredited institution. Each child may be used as a deduction once only. So if both parents work, only one of them may claim the deduction for the child.

Tax on Salary calculation

According to Article 42 (new) of the Law on Taxation, the term ‘’salary” refers to wages, remuneration, bonuses, overtime, other compensations and fringe benefits which are paid to an employee, or which are paid for the direct or indirect advantage of an employee for the fulfillment of employment activities.

In order to calculate tax on salary of a resident employee, the gross monthly salary will first need to be adjusted to take into account the spouse and dependant child rebate. Moreover, employees of factories, are allowed to exclude from the taxable salary base allowances as provided in Circular No. 011 dated 6 October 2016 (please click here for further detail).

TOS Formula

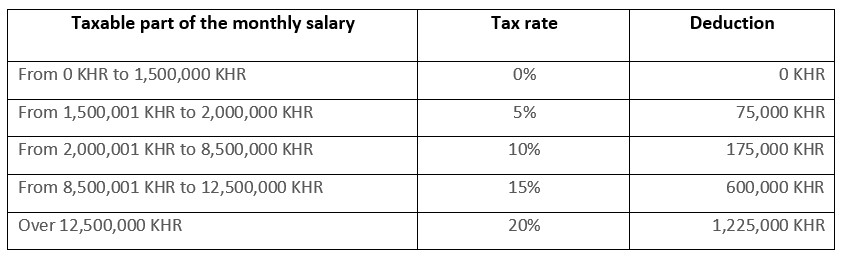

The formula taking into account the new monthly progressive tax on salary rates and tax bracket deduction is as follows:

Rebate for dependent children and spouse (housewife) = KHR 150,000 × Number of dependent children and spouse (housewife)

· Tax base for TOS calculation = Taxable salary – Rebate for dependent children and housewife

· TOS calculation = (Tax base for TOS calculation × TOS rate) – Deduction

Example of TOS calculation:

1. A resident employee receives a monthly salary of KHR 2,000,000 which includes travelling and meal allowances of KHR 200,000.

a. In this scenario the employee is single:

– TOS Base= KHR 2,000,000 – KHR 200,000 = 1,800,000 _ TOS rate is 5%

– Deduction = KHR 75,000

– TOS= (KHR 1,800,000 × 5%) – KHR 75,000= KHR 15,000

b. In this scenario the employee has 1 spouse and 3 dependent children

– Rebate = KHR 150,000 × 4= KHR 600,000

– TOS Base = KHR 2,000,000 – KHR 200,000 – KHR 600,000 = KHR 1,200,000 _ TOS rate is 0%

– TOS = (KHR 1,200,000 × 0%) = KHR 0

2. A resident manager receives a monthly salary of KHR 9,000,000.

a. In this scenario the manager is single:

– TOS Base = KHR 9,000,000 _ TOS rate is 15%

– Deduction = KHR 600,000

– TOS= (KHR 9,000,000 × 15%)- KHR 600,000= KHR 750,000

b. In this scenario the manager has 1 spouse and 3 dependent children

– Rebate= KHR 150,000 × 4= KHR 600,000

– TOS Base = KHR 9,000,000- KHR 600,000= KHR 8,400,000 _ TOS rate is 10%

– Deduction = KHR 175,000

– TOS = (KHR 8,400,000 × 10%) – KHR 175,000= KHR 665,000

The DFDL tax team has a vast and varied depth of experience with regard to the application of tax treaties, and as always, we stand ready to answer any questions that you may have on this and other tax issues of concern.

Tax services required to be undertaken by a licensed tax agent in Cambodia are provided by Mekong Tax Services Co., Ltd, a member of DFDL and licensed as a Cambodian tax agent under license number – TA201701018.

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.