By Jack Sheehan and Anna Zafirova

A significant milestone was passed on 4th November 2012 with the signing of the Luxembourg – Lao PDR Double Tax Agreement (“DTA”). Luxembourg is the first European country to sign a DTA with the Lao PDR.

Luxembourg is widely-used in international tax planning as a holding company location for outbound investments. The addition of Luxembourg to the list of possible holding company locations for Lao investments will be a welcome and interesting development for those interested in investing or restructuring existing investments in the Lao PDR.

DTAs are often seen as the cornerstone of international tax planning and structuring. The provisions of a DTA offer many benefits such as reduction in withholding tax (“WHT”) rates imposed on dividends, interest payments and royalties and exemption from taxes applicable to service fees and capital gains.

To understand the possible benefits the Lux-Lao DTA can offer to foreign companies in Laos, we must first look at tax implications of profit repatriation and capital gains under Lao domestic Tax Law before applying the provisions of the DTA….

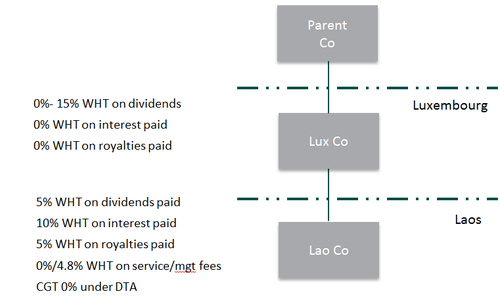

Luxembourg Holding Company Structure

The main tax effects of repatriation of profits from a Lao operating company (“Lao OpCo”) to a holding company located in Luxembourg (“Lux HoldCo”) are illustrated below:

Payments of dividends, interest payments, royalties and service fees

Dividends

Under Lao Amended Tax Law dividends paid by a Lao company to a non-resident shareholder are subject to a withholding tax of 10%.

Upon entry into force of the new DTA, dividends paid from a Lao Op Co to a shareholder/holding company located in Luxembourg (“Lux Hold Co”) can enjoy a reduced WHT of 5% providing that the shareholder is the beneficial owner of the dividends and it holds directly at least 10% of the capital of the Lao company.

Additional flexibility is provided by the fact that there is no minimum holding period (12 months in some DTAs).

Interest Payments and Royalties

The Lux-Lao DTA provides a cap on the level of WHT that can be applied to interest payments at 10% and royalties at 5%. These are the same rates of WHT under the Amended Tax Law and therefore the DTA does not offer any reduction for WHT on interest payments and royalties.

Capital Gains

Under Lao Amended Tax Law capital gains realized on the sale of shares in a Lao Op Co is subject to a WHT of 10%. According to the new Lux-Lao DTA, gains other than from alienation of immovable property, movable property forming part of a PE, or vessels operated in international traffic, shall be taxable only in the Contracting State of which the alienator is a resident.

In other words, gains realized from the sale of shares in a Lao Op Co will only be taxable in Luxembourg as the DTA provides relief from double taxation.

Service Fees and Other Cross-border Payments

Upon entry into force of the provisions of the Lux-Lao DTA, the above taxation will only apply to non-residents that have reached a certain level of taxable presence in Laos by having a Permanent Establishment (“PE”) situated therein. A PE is defined under the DTA as a fixed place of business through which the business of an enterprise of a contracting state is wholly or partially carried on in the other state and specifically lists: a place of management, a branch, a factory, a place of extraction of natural resources, farm, plantation etc.

Further, the definition of PE encompasses two important types of PE, namely a “Construction PE” and a “Service PE”. In order to be qualified as a PE, the building site, construction, installation or assembly project or supervisory activities in connection therewith should continue for a period of more than 6 months.

In respect of the Service PE, the furnishing of services, including consultancy services should be present in Laos for a period exceeding 6 months within any 12-month period.

Applied in practice, a resident Lux company will not be subject to tax in Laos on its profits derived in Laos unless it can be shown a PE exists. In claiming this relief, the Lux resident company can seek an exemption from the withholding profit taxes which are currently 4.8%.

Is indeed Luxembourg the best location to invest through in Laos?

Apart from the tax benefits outlined above, dividends received in Luxembourg will be exempt from corporate income tax in Luxembourg providing that the dividend is paid by a fully-taxable resident company and subject to a tax comparable to the Luxembourg CIT (a rate of at least 10.5% is required at present). This condition is already satisfied as the standard rate of CIT in Laos is 24%.

Luxembourg does not impose any WHT on the payment of royalties and interest (unless interest on profit-sharing bonds) and has relatively broad scope of exemptions for dividends and service fees, including fees for technical services or management fees.

Luxembourg attracts investors from all over the world. Being a small dot on the European map, Luxembourg has an advanced legal and financial system, an extensive network of DTA (over 60 in force at present) and all the benefits of being an EU member state. The country is not only an ideal location for setting-up new investment vehicles for business operations in Lao PDR, but also for re-locating existing corporate structures either by redomiciliation of the parent company, by simple transfer of its shares or by using the tax-beneficial restructuring schemes available under the EU Merger Directive.

In practice, if the benefits accorded under the DTA and Luxembourg local tax legislation are combined, the most tax advantageous scenario for outbound dividend distribution from Laos will be to a Lux Hold Co having at least 10% direct holding in a Lao Op Co – a reduced 5% withholding tax rate will be due on dividends paid from Laos. Additionally, the dividends received will be exempt from tax in Luxembourg.

With the signing of the new DTA, the Lao PDR may have opened up an attractive route for investors to its doorsteps. Albeit not yet in force, it is expected that the process of ratification will be completed within a year and the DTA will be effective as of January 1st, 2014.