Myanmar continues to push tax reforms with the passage of five new tax laws. Notable changes include amendments to the personal income tax rates and their application; expansion of the scope of Commercial Tax (“CT”) on services; and adjustment to stamp duty rates.

On 28 March 2014, the Union of Myanmar Revenue Law of 2014 and four other tax bills were signed into law and effective from 1 April 2014. The Revenue Law of 2014 essentially legislates and introduces changes to the rates for Income Tax and CT, which were previously determined based on Notifications by the Minister of Finance and Revenue. The other new laws include separate amendments to the Income Tax Law, Commercial Tax Law, the Stamp Duty Law and the Court Fee Act.

We provide below a comparison of the salient modifications introduced by the new laws:

Income Tax

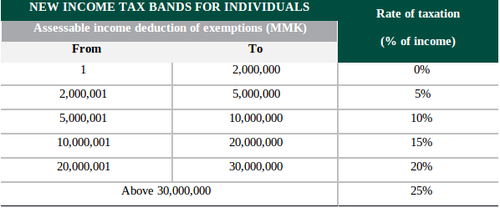

1. The Personal Income tax (“PIT”) rates and income bands have been changed. The top rate has increased to 25% from the old 20%. The income band rates have been adjusted. For instance, under the old law, the exempt income band was only up to MMK 500,000, but now it has increased to MMK 2,000,000.

The tax table is now as follows:

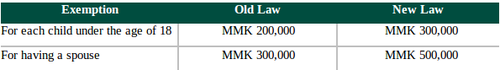

2. The available exemptions for Myanmar residents having children and/or spouses have also been increased, as follows:

3. Income by individuals from profession, business, property and other income are now subject to tax in the same way as tax on salary. Previously, such types of income were subject to an income tax of 2% to 30%. Under the new law, all these types of income are added together with salary and subject to the income bands and tax rates in the table above.

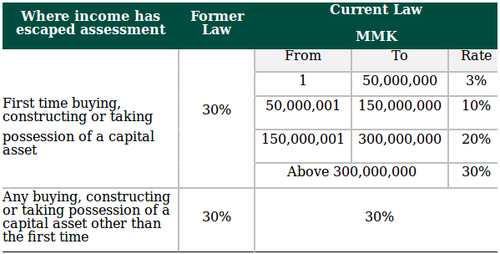

4. Under the old income tax law, a person wishing to purchase immovable property was required to prove the source of the funds to be used for the purchase. If the individual cannot prove the source of the funds, a 30% tax on “income from undisclosed sources” would be applied to the purchase price..

Under the new Union Revenue Law, a person buying property for the first time will be granted a slight reprieve. “Income that has escaped assessment” will now be subject to a graduated rate of 3-30% of income tax for such first purchase. Subsequent purchases, however, will be subject to 30%.

5. The new Union Revenue Law retains the same Corporate Income (“CIT”) rate of 25% that was applied under the old law and notifications. However, newly set-up small and medium enterprises shall not be subject to income tax for a period of three years or until the enterprise earns revenue in excess of MMK 5,000,000, whichever occurs first.

6. The amendments to the Income Tax Law mentions “self-assessment” by the tax payer. In general, in the self-assessment system, the taxpayer bears the responsibility of declaring, computing and paying his or her own income tax. In this system, the assessment by the tax authority comes at a later time through a subsequent tax audit. Under the current practice in Myanmar, the taxpayer submits the tax returns, but does not pay until the returns are assessed by the tax officer and a payment order is made. This system can make payment and collection of tax rather time-consuming and inefficient.

It is unclear for now whether the inclusion of the term “self-assessment” will pave the way for a self-assessment system in Myanmar.

Commercial Tax (“CT”)

1. CT now applies to all types of services unless specifically exempted. This is reverse of the previous rule that CT does not apply to services unless specifically provided for. Thus, CT will be applied in a greater number of services. It is unclear, however, whether service providers can now claim CT input credits.

Below are the services specifically exempt by the Union Revenue Law of 2014:

- House rental services

- Car parking services

- Life insurance services

- Microfinance services

- Health care services

- Education services

- Transportation of goods

- Services of employment agencies

- Banking services

- Customs clearance services

- Renting out objects such as tables, chairs or crockery for social functions

- Licensed slaughtering of animals

- Contract manufacturing

- Funeral services

- Container transport services

- Child nursery services

- Myanmar traditional massage / massage performed by a blind person

- Moving services

- Services for which a road toll is charged

- Animal health care services

- Services consisting in the provision of public toilets

- Outbound air transport services

- Services concerning culture and art

- Information technology services

- Technology and management consultancy services

- Public transport services (bus, railway and ferry)

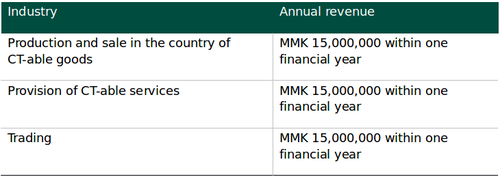

2. No CT shall be assessed from businesses in the cooperative sector or private sector if their sale proceeds or revenue from services do not exceed the following amounts:

-

Similar to the old law, CT generally applies to the manufacture and sale, trading and importation of all types of goods. Under the new law, there are still a number of goods exempt from CT when produced in Myanmar, but subject to CT when they are imported. These consist mostly of agricultural and other essential goods. There are also a number of goods that are exempt from CT irrespective of whether they are imported produced and sold or traded in the country. These include fertilizers, insecticides, medical equipment, textbooks, military equipment, among others.

-

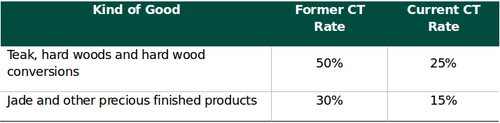

Schedule 6 to the Commercial Tax Law identifies non-essential goods whose import or sale within Myanmar carries a higher rate of CT than the standard 5% applicable to most goods. The rates contained in Schedule 6 stayed the same except for the following changes:

-

Export CT applies to crude oil (5%), natural gas (5%), teak and hardwood logs (50%), jade, rubies, sapphires, etc. (30%) and jewelry made from jade, rubies, sapphires, etc. (10%).

-

Local entrepreneurs and state-owned enterprises get a break from CT. In order to encourage competition with imported goods, only 2% CT is levied on the proceeds from the sale of goods which are produced and sold by registered citizen entrepreneurs or production businesses owned by citizen entrepreneurs or state‐owned enterprises.

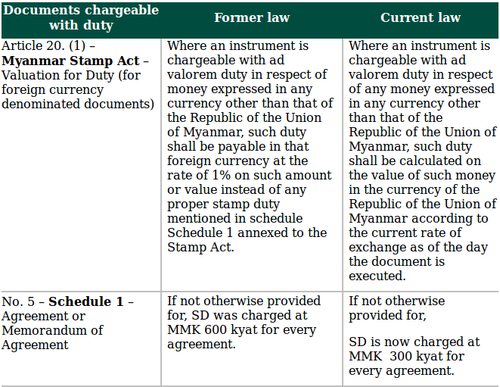

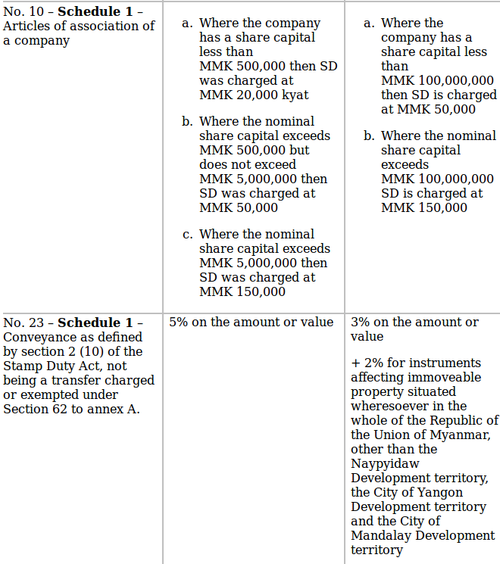

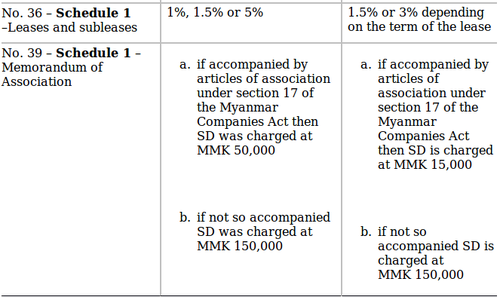

Stamp Duty

The Stamp Act has been amended in many respects. The most significant change is the amendment to Section 20 which pertains to the taxation of foreign currency denominated documents. Section 20 now reverts to the older rule of merely converting the foreign currency to Myanmar Kyats (MMK) and applying the regular ad valorem rate. For most documents, the erstwhile rule of 1% rate for foreign currency denominated documents can be steep compared to documents denominated in MMK. There are a few documents where the defunct 1% rate is lower

, such as for instance conveyances which apply a 3% to 5% rate of SD.

We detail below the most relevant changes to the Stamp Act:

Contacts

We trust you find the information contained in this DFDL client alert helpful. If you have any further questions, please contact:

Jack Sheehan

Partner, Regional Tax Practice Group e: [email protected]

Bernard Cobarrubias

Director, Regional Tax Practice Group e: [email protected]