As a part of the comprehensive partnership enhancement between the United States (“US”) and Vietnam, on 7 July 2015, the two countries signed the first income tax treaty and the Protocol for the avoidance of double taxation and prevention of tax evasion/avoidance (Double Tax Treaty or “DTT”). The DTT and its Protocol will enter into force once ratified by the US and Vietnam.

Generally, the DTT conforms to the US Model on Income Tax Treaty (2006) (“US Model Treaty”), with certain modifications. Key provisions of the DTT are outlined below.

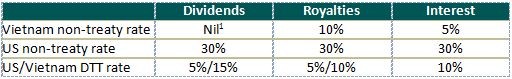

1. The DTT provides limitation on the imposition of withholding tax with respect to certain incomes. The following table sets out the withholding tax rates for dividends, royalties and interest with and without the DTT.

◘ Dividends (Article 10)

- Dividends paid by a company which is a resident of a Contracting State to a resident of the other Contracting State may be taxed in that other State.

However, the dividends may be taxed in the Contracting State of which the company paying the dividends is a resident. The DTT limits the withholding tax rate imposed by the sourced-country where the dividends are derived as follows:

- Article 10(2)(a) provides that dividends are taxable at a maximum rate of 5% if the beneficial owner:

(i) is a Vietnam company (tax resident of Vietnam) that owns directly at least 25% of the voting stock of a US company (US tax resident) paying the dividends; or

(ii) is a US company that owns directly at least 25% of the capital of a Vietnam company paying the dividends.

- Dividends other than the above are subject to withholding tax at 15%.

Note that, since Vietnam currently does not impose withholding tax on dividends paid to a corporate shareholder, the application of the DTT will not be necessary.

[ 1 ] Currently, Vietnam does not impose dividends withholding tax distributed to non-resident shareholders that are corporate/organization (as opposed to individuals).

◘ Interest (Article 11)

The DTT limits the interest withholding tax rate at 10%. This is contradictory to the US Model Treaty which generally provides tax exemption in the sourced-country for interest payment to resident of other Contracting State.

In addition, Clause 4 of Article 11 stipulates that if the interest payments are determined with reference to receipts, sales, income, profits or other cash flow of the debtor, to any change in the value of any property of the debtor or to any dividend, partnership distribution or similar payment made by the debtor, the payments can be taxed at a maximum rate of 15%.

From a US perspective, the Protocol specifies that contingent interest arising in the US that is not qualified as portfolio interest under US law will be subject to Clause 4 of Article 11.

Note that Vietnam applies only a 5% withholding tax on the interest paid to a beneficial owner that is a tax resident of US. Thus, the application of the DTT in this case will not be necessary.

◘ Royalties (Article 12)

This Article has been modified (in comparison to the US Model Treaty) under the DTT when indicating the DTT applies based on the residency of the payer, rather than the location where the property is utilised.

The withholding tax rate at the sourced country where the royalties arise is limited to:

- 5% of the gross amount of the royalties paid for the use of, or the right to use, industrial, commercial, or scientific equipment, excluding the following which will be subject to Article 7 (Business profit) of the DTT:

(i) Payments for the rental on a bareboat basis of ship or aircraft if such ships or aircraft are operated in the international traffic by the lessee; or

(ii) Payments for the use, maintenance or rental of containers (including trailers, barges, and related equipment for the transport containers), except those containers are used for transport solely between places within the other Contracting State.

- 10% of the gross amount of the royalties paid for the use of, or the right to use any copyright of literary, artistic, scientific or other work (including cinematographic films, films or tapes used for radio or a patent, trademark, design or model, plan, secret formula, or process).

However, the royalties arising in connection with a permanent establishment or fixed base in the sourced-country will be subject to Article 7 of the DTT, rather than this Article 12.

Vietnam currently imposes 10% withholding tax on royalties paid to non-resident recipients. Thus, a reduced rate of 5% is applied in cases the royalty is paid for the use of, or the right to use, industrial, commercial, or scientific equipment.

2. Permanent establishment (“PE”)

In comparison to the US Model Treaty, the PE is broadly defined under Article 5 of the DTT to include service PE and agency PE. Further, the PE period is shortened to 6 months or more (rather than 12 months or more under the US Model Treaty).

Under the DTT, PE generally encompasses:

- A building site, construction, exploration, assembly or installation project of supervisory services if such site or project or activities last more than six months.

- Service PE: the furnishing of services, including consultancy services, by an enterprise (which is tax resident of a Contracting State) through employees or other personnel engaged by the enterprise for such purpose, but only if activities of that nature continue (for the same or a connected project) within other Contracting State for a period or periods aggregating more than 183 days within any twelve month period.

- Agency permanent establishment: “dependent agent” in the sense of the Treaty can be any person other than an agent of an independent status is acting on behalf of an enterprise and has, and habitually exercises, in a Contracting State an authority to conclude contracts in the name of the enterprise, that enterprise shall be deemed to have a permanent establishment in that State in respect of any activities which that person undertakes for the enterprise.

3. Gains from alienation of property (including capital gains) (Article 13)

Article 13 provides the following with respect to gains from the alienation of property (for purposes of this article, we do not address the transfer of aircrafts or ships or movable property):

- Paragraph 1: Gains derived by a resident of one Contracting State in connection with the sale of immovable property situated in the other Contracting State will be subject to tax in the other Contracting State.

- Paragraph 2 provides the following specific provisions relating to immovable property (in addition to Paragraph 1):

o The US has the right to tax on the gains from the sale of real property situated in the US;

o Vietnam has the right to tax on the gains from the sale of the shares of capital stock of a company, or of an interest of a partnership, trust or estate, that derives more than 30% of its asset value from immovable property (directly or indirectly) situated in Vietnam.

We note that the above 30% threshold of the value of immovable property for capital gains imposition is lower than other treaties within Vietnam’s tax treaty network, which is typically 50%.

- Paragraph 5: Gains from the transfer of property other than the above may only be taxed in the state in which the transferor is a resident.

4. Employment income (Article 15)

Generally, employment income

shall be taxed in the State where the employee is a tax resident, unless the employment is performed in other Contracting State. In this case, the income may also be taxed in the other Contracting State. However, the other State cannot tax if:

- The recipient is present in the other State less than 183 days in a twelve-month period commencing or ending in the tax year concerned; and

- The remuneration is paid by, or on behalf of, an employer who is not a resident in the other State; and

- The remuneration is not borne by a PE or a fixed base which the employer has in the other State.

The above can be interpreted, for instance, in the case of an American employee working in Vietnam. The American employee will be exempt from Vietnamese personal income tax if:

- He/she does not spend more than 182 days in Vietnam in any 12-month period in a tax year concerned; and

- His/her remuneration is not paid by, or on behalf of, an employer who is a resident of Vietnam; and

- The remuneration is not borne by a PE in Vietnam.

5. Limitation on Benefits (Article 23)

With respect to anti-treaty shopping, the DTT includes a Limitation on Benefits (“LOB”) provision, which is contained in most of the treaties in which the U.S. is a signatory. Under the LOB provision, a resident will not be entitled to treaty benefits unless such resident is considered as a “qualified person”, as defined under Article 23 of the DTT.

Accordingly, a “qualified person” includes the following

– An individual;

– A Contracting State, or a political subdivision or local authority;

– A publicly listed company;

– A subsidiary of a publicly listed company which is a resident in either Contracting State;

– A pension fund or charitable organization;

– A company that meets the ownership/base erosion test: (1) at least half the days in a taxable year certain residents of either Contracting State that are entitled to treaty benefits own (directly or indirectly) at least 50% of each class of shares or beneficial interests in the entity; and (2) less than 50% of the entity’s gross income for the taxable year is paid or accrued (directly or indirectly) to third country residents in the form of payments that are deductible for income tax purposes in the entity’s State of residence;

– Active trade or business (or connected persons test);

If none of the above is satisfied, the Contracting State may determine at its discretion to allow treaty benefits based on the purpose for the entity to seek treaty benefits.

The LOB provision in the U.S.-Vietnam DTT includes a paragraph relating to triangular cases, which is not found in the US Model Treaty. Accordingly, Article 23(6) provides that where an enterprise in a Contracting State (i.e., State A) derives income from the other Contracting State (i.e., State B), and such income is attributable to a permanent establishment of the enterprise in a third jurisdiction (i.e., State C), then treaty benefits would not be permitted if the profits of that permanent establishment are subject to a combined aggregate effective rate of tax in State A and State C that is less than 60% of the general rate of company tax applicable in State A. If the provisions of Article 23(6) apply, any dividends, interest or royalties will be subject to tax in State B at a maximum rate of 15%. Any other income would be subject to tax under the provisions of the domestic law of State B.