On 2 April 2015, the Union Tax Law of 2015 was enacted into law. Introducing new tax rates and other refinements to the 2014 version, the law will have retroactive effect from 1 April 2015.

The major changes include:

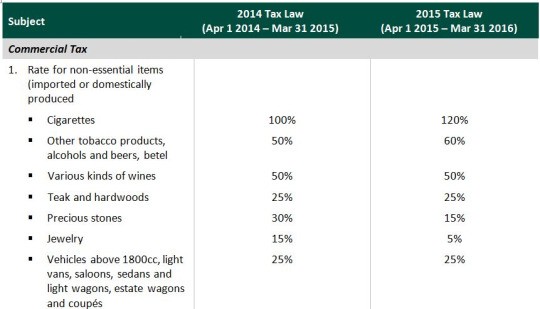

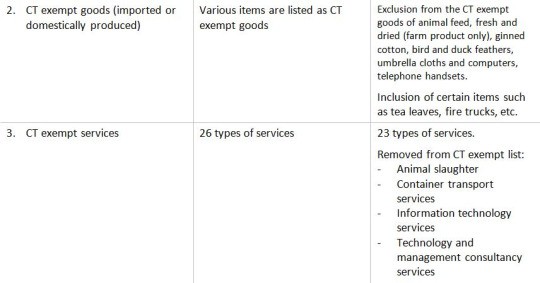

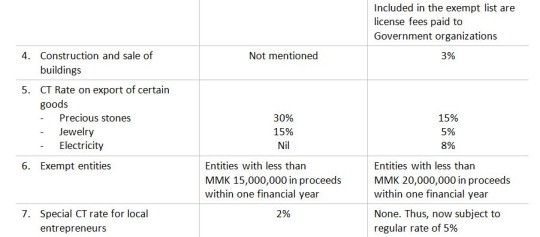

- Commercial Tax (“CT”) –shorter list of CT exempt service activities; new CT rate of 3% on construction and sale of buildings; increase in CT rates on certain items

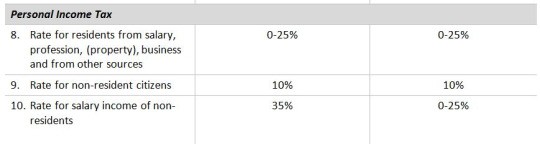

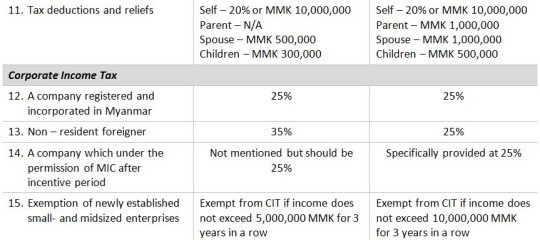

- Personal Income Tax (“PIT”)– salary of non-resident foreigners now subject to graduated rate of 0-25%,instead of the flat rate of 35%; new deductions for parents living with thetaxpayer; higher personal, spouse and dependent deductions

- Corporate Income Tax (“CIT”) – rate of CIT for non-residents reduced from 35% to 25%

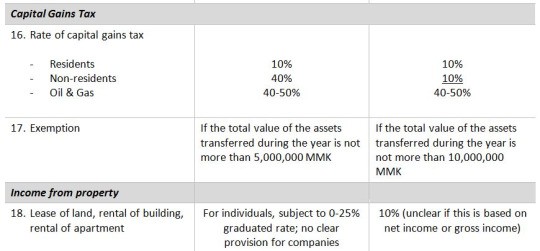

- Capital Gains Tax (“CGT”) – rate of CGT for non-residents reduced from 40% to 10%

- Income from property – rate of 10% CIT on income from lease of land, rental of building, rental of apartment.

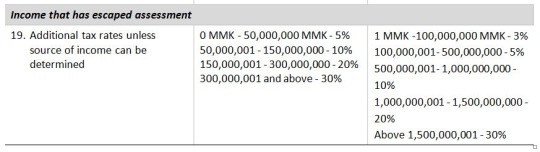

We compare below the provisions of the 2014 and the 2015 Tax Laws:

We continue to encourage discussions with our clients as to how these new policies may impact your business in Myanmar. Do write to us if you have specific questions. We will soon likely schedule an event in Yangon to discuss with our clients the details of the new law as the other new legislation and notifications recently issued.

Please don’t hesitate to contact our team.

Jack Sheehan

Tax Partner

jack.sheehan@dfdl.com

Bernard Cobarrubias

Tax Director – Regional Tax Practice

bernard.cobarrubias@dfdl.com

Adam McBeth

Legal and Tax Advisor

adam.mcbeth@dfdl.com

K. Khine Phyo

Tax Compliance Professional

k.khinephyo@dfdl.com