On 1 October 2012, the Amended Tax Law (№ 05/NA, 20 December 2011) is expected to come into force in the Lao PDR. The Amended Tax Law represents the first legislative amendment to the Tax Law (№ 04/NA, 19 May 2005) and will introduce significant changes for taxpayers in the Lao PDR. The implementation of the Amended Tax Law will be further subject to details to be provided in an implementing decree.

Some of the key changes under the Amended Tax Law are as follows:

- Business Turnover Tax: Business Turnover Tax (“BTT”) will be abolished and replaced by the Value Added Tax (VAT). As a result, the supply of goods and services will be taxed at 10% rather than 5%. [The types of goods and services affected by the abolition of the BTT are land excavation, sand scooping and land clearing for construction, printing services, cleaning services, security services, insurance activities, machinery and equipment used in clearing, mining, oil and gas exploration and infrastructure construction. The scope of VAT is much wider in application and applies a standard rate of 10% to the supply and importation of goods and services in the Lao PDR.

- Profit Tax: The standard rate of Profit Tax will be reduced from 28% to 24%. However, businesses that are granted a lower profit tax rate under the Foreign Investment Law will be able to continue paying profit tax at that rate. Companies that are currently paying a higher rate of profit tax, for example banks, will be subject to a lower rate of 24%. A special profit tax rate of 26% will be applied to companies engaged in the manufacture, import and sale of tobacco.

- Publicly Listed Companies: Companies which are listed on the Lao Securities Exchange will enjoy a reduction in the profit tax rate of 5% for four years.

- Minimum Tax: The Minimum Tax will be abolished. Previously the Minimum Tax was imposed on the revenues of all companies that either made profits below a certain level or made losses in a tax year. The practice under the Amended Tax Law is to calculate Profit Tax on an actual basis based on revenue less deductible expenses with no payment of minimum tax should the business report a loss.

- Travel Expenses: Travel expenses will be deductible in an amount of up to 0.6% of total annual turnover (previously 0.4%).

- Donations: Donations will be deductible in an amount of up to 0.3% of annual turnover (currently, donations are non-deductible).

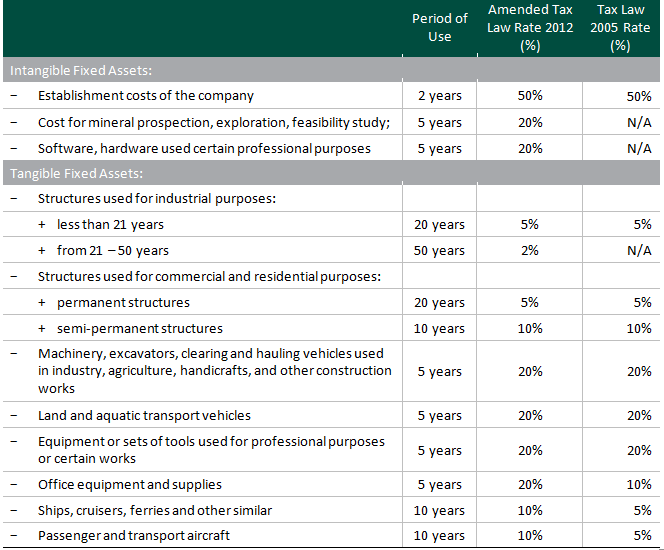

- Depreciation Rates: Allowable depreciation rates will change under the Amended Tax Law as follows:

- Mineral prospecting, exploration and feasibility study expenses: Mineral prospecting, exploration and feasibility study expenses paid before and after incorporation of an entity in the Lao PDR will be deductible for tax purposes provided the costs are certified by the relevant ministries and the tax authorities.

- Deductible and Non-deductible Expenses: Expenses will be deductible unless specified as a non-deductible expense in the Amended Tax Law. The Amended Tax Law lists the following classes of expenses as non-deductible.:

- Profit Tax expenses;

- VAT in connection with the purchase of fixed assets;

- Depreciation deducted pursuant to accounting standards;

- Consumable expenses and depreciation on fixed properties which are not listed as assets of the enterprise;

- Salaries which are paid to individuals who are not managers or employees;

- Interest on loans that are used to pay for a capital investment or share contribution;

- Interest on non-bank loans and interest paid on related party debt;

- Interest on loans not directly connected to business operations;

- Expenses not directly connected to business production operations such as: golfing, dancing, entertainment, gifts, prizes etc.;

- Personal expenses of the enterprise owner or partners;

- Unsubstantiated expenses;

- Expenses paid to other individuals lacking contracts or supporting documentation;

- All categories of reserve deductions pursuant to accounting standards;

- Amortization of assets pursuant to accounting standards (amortization of value of fixed property, goods in stock, debt defaults, etc.);

- Losses on the valuation of assets, foreign currency debts on accounts closing date;

- Accruals; and

- All types of fines.

Expenses which are not included in the above list and which are used as part of the business operations will be deductible.

- Losses carried forward: Losses can be carried forward for three years. To be carried forward, losses must be certified by the National Audit Authority or an independent audit company. Any losses that are not utilized after three years will be lost.

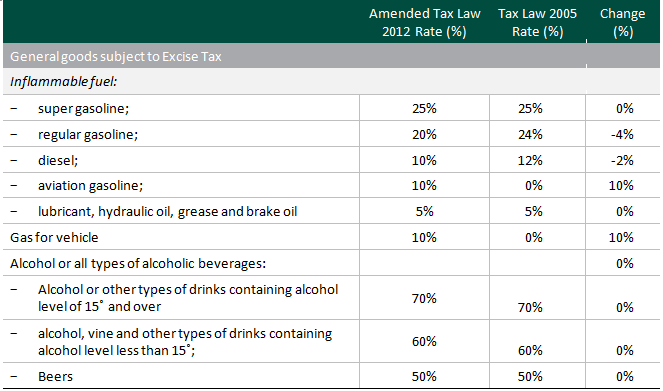

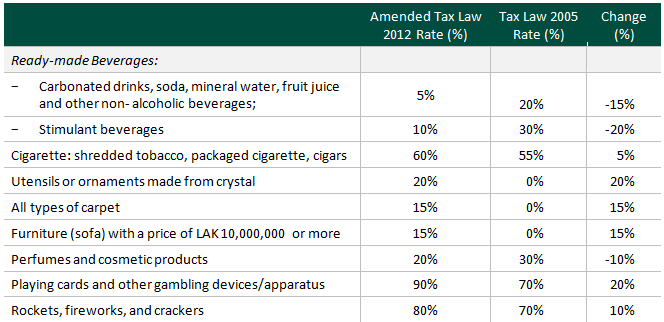

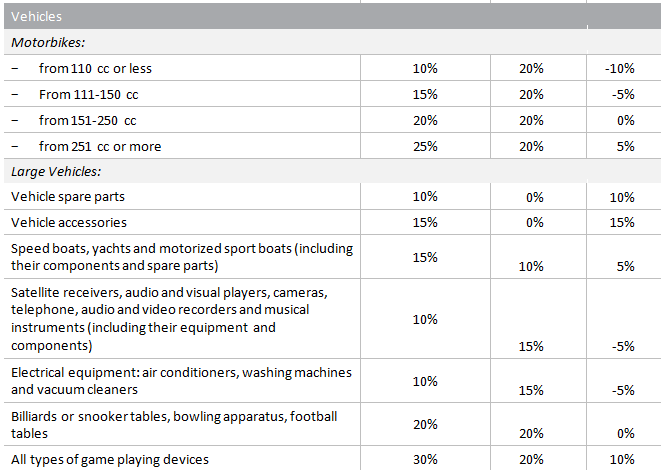

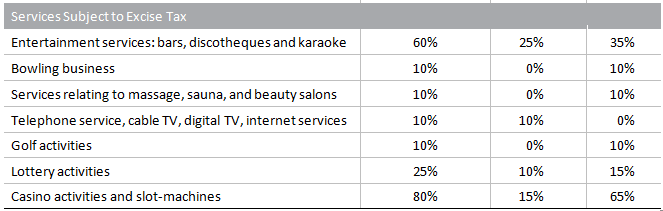

- Excise/Use Tax: Excise Tax rates will change for certain categories of goods and services as follows:

Personal Income Tax:

- The 180 day residency rule for foreigners will be abolished. Foreigners who work in the Lao PDR and receive salaries paid overseas will be subject to tax in Lao PDR on that employment income. Currently, foreign employees are subject to income tax on foreign sourced employment only if resident in the Lao PDR for 180 days or more in any year.

- This income tax change could prove to be problematic for employees on short term assignments.

- A 183 day rule for foreign sourced employment income may still apply under a double tax agreement.

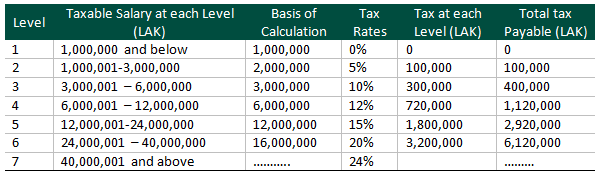

- Personal Income Tax (PIT) rates will be reduced from a progressive rate of 0% to 28% to 0% to 24%. The PIT rates under the Amended Tax Law are as follows:

Income on salaries, wages, bonuses, overtime, position and title honoraria, annual allowances, Board of Directors meeting allowances and other monetary or material benefits is subject to a uniform progressive income tax rate of between 0% and 24% , as follows:

Fx Rate: USD 1: LAK 8,045

Article 7 of the Amended Tax Law provides for an exemption and/or reduction of tax obligations in the following cases:

- In compliance obligations under double tax agreements (DTAs), and other conventions in which the Lao PDR is a signatory;

- Performance of provisions prescribed in the Law on Investment Promotion;

- Performance of Resolution of the National Assembly for important projects at nationa

l level; - Performance of National Assembly Standing Committee agreements based on Government proposals on providing special tax exemption policies in the event of force majeure or natural disaster, such as storms, disease outbreaks, floods, draughts, earthquakes, fires and other disasters which cause great damage.

The Government of Lao PDR has issued some notifications on the implementation of personal income tax rates which do not align with the provisions of the Investment Promotion Law and rights and obligations granted under agreements such as concession agreements insofar as they relate to foreigners. We await the release of the Amended Tax Law’s implementing decree for further guidance on which personal income tax rates will apply to such foreign employees.

Withholding Taxes: The withholding taxes on passive income will be unchanged except for income from leases which will be reduced to 10% (previously 15%) and income from the sale-transfer of land use rights which will be subject to income tax at 5% (previously exempt).

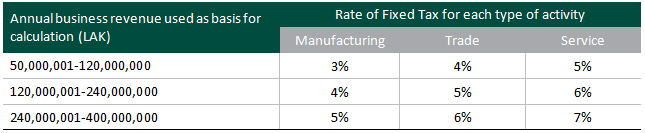

Lump Sum Tax:

- A new Lump Sum Tax will be introduced which will apply to small to medium businesses with revenues below LAK 400,000,000 (approximately USD 50,000).

- Small to medium businesses with business incomes of LAK 12,000,000 or less are exempt from payment of the Lump Sum Tax.

- Small to medium businesses with business incomes between LAK 12,000,0001 and LAK 50,000,000, will pay a Lump Sum Tax which shall not exceed LAK 600,000.

- Small to medium businesses with business incomes from LAK 50,000,001 to LAK 400,000,000, will pay the following rates of Lump Sum Tax:

Tax Planning Considerations:

- Companies should defer revenue or bring forward expenditure where possible.

- If losses or low revenue is expected, a Minimum Tax of 1% will be payable on all revenue during the current accounting period. From a tax planning perspective it may be advisable to review the starting dates of contracts or postpone agreement dates until after implementation of the Amended Tax Law to avoid paying 1% Minimum Tax on the income.

- Contracts and agreements entered into with BTT of 5% should be renewed to account for the additional 5% exposure (VAT of 10% now applicable).

- Traders and manufacturers of goods subject to excise tax changes should either defer or bring forward supplies for importation depending on if the rate will increase or decrease.

- Depreciation schedules and journals will need to be revised to account for the new allowable depreciation rates (as above).

- Companies currently paying a profit tax rate higher than 24% (for example banks and domestic entities at 35%) will be subject to a lower rate of profit tax. Such companies may consider reviewing its current year revenue recognition policies and recognize income where possible in the following accounting period.

- Companies paying a profit tax rate below 24% will be unaffected by change in the profit tax rate.

- Employees on short term contracts will be subject to income tax at a progressive rate of 0% to 24%. Employers may consider paying a higher portion of the salary before the Amended Tax Law is implemented.

- Expenses previously treated as non-deductible may be deductible under the Amended Tax Law provided it can be shown the expense relates to business operations. It is advisable to review the current list of expenses which are currently non-deductible. If such expenses are deductible under the Amended Tax Law, it may be tax efficient to incur the expenditure in the next accounting period to gain the tax benefit of tax deductibility due to the changes in the Tax Laws.

We trust you find this article helpful, please do feel free to contact us with any queries in respect of the Amended Tax Law.

DFDL is running a free breakfast seminar in September to prepare our clients for the introduction of the Amended Tax Law. To register your interest in attending this event, please email your details to: mina.korlasak@dfdl.com